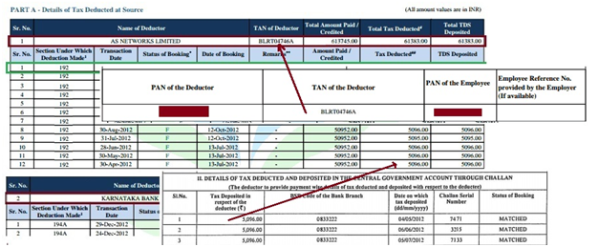

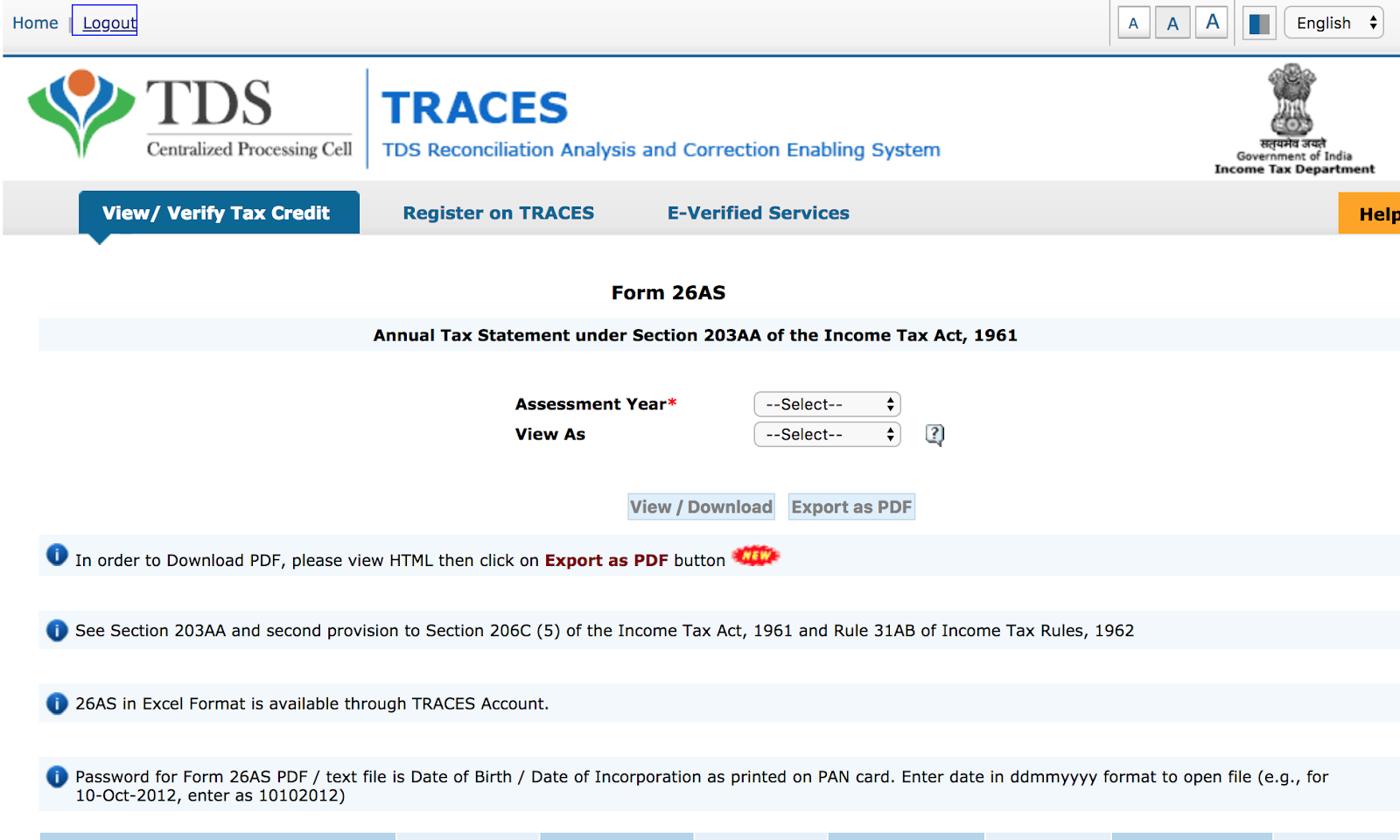

Even people without any prior tax knowledge can use this portal for pre-filling the returns and minimising data entry effort in filing their ITRs. The taxpayer-friendly software will involve interactive questions which will help taxpayers. With this new portal, taxpayers will be provided with free-of-cost offline and online ITR preparation software. The tax credit details can be accessed by the registered users. Download and save the Form 26 AS for future usages. Check online tax credit statements provided by the Income Tax Department for the tax payers.Your Form 26As will be displayed on the computer monitor or the cell phone screen.Click on 'View Tax Credit (Form 26AS)’ option.At TDS-CPC website, agree to the acceptance of usages and click on 'Proceed' option.After clicking at the 'Confirm' button of disclaimer, you will be redirected to the TDS-CPC website.Step 1: Login to Income Tax e-Filing Website to download Form 26AS Step 2: After logging into your account, the following screen will appear. Read the disclaimer carefully and click on the 'Confirm' button You can download Form 26AS from TRACES website or using netbanking facility of authorized banks.After logging in, go to the 'e-file' menu and click on the 'View Form 26 AS (Tax Credit)' link.

Click on 'Login' option on the top right of the home page.Part A, Part B, Part C, Part D, Part E, Part F, and Part G are the seven parts of Form 26as. Log in at the official income tax new website - To finish the process, select View/ Download.How to download Form 26 AS from income tax new portal: After, the launch of new income tax website, a taxpayer can now know one's tax-related details by simply downloading Form 26AS from the new portal. It is also known as annual consolidated statement, is an important document that contains all tax-related information of the taxpayer like TDS (Tax Deduction at Source), advance tax, etc.

0 kommentar(er)

0 kommentar(er)